Learn how to pay off debt and invest in index funds

Signed in as:

filler@godaddy.com

Learn how to pay off debt and invest in index funds

Signed in as:

filler@godaddy.com

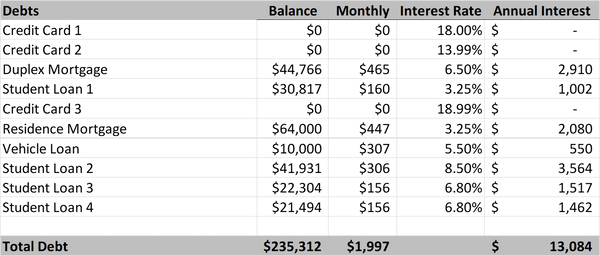

You're wondering why the total doesn't equal $260K.

I paid off $24K by closing my 401k just a few months prior to this.

(Not my finest moment)

Seeing this $16K in annual interest expense was a significant turning point. I would never get wealthy if I continued paying this interest.

Actions I took:

- Wrote out all my debts and their interest rates

- Calculated the annual interest expense

- Updated this tracker every paycheck

I hadn't made any progress on the debt, but my annual interest expense was down to $13K.

Actions I took to lower the interest expense:

- Refinanced my house to lower interest rate

- Refinanced my car to lower interest rate

- Consolidated high-interest credit cards into lower-interest debt

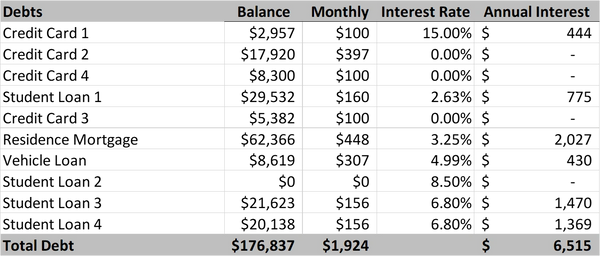

I sold a duplex for $8K less than I had paid for it 4 years earlier.

Even though I sold it for a loss:

- it relieved so much stress

- my total debt reduced significantly

- my annual interest was cut in half

I also started using 0% credit card deals this year.

I was getting good at living lean.

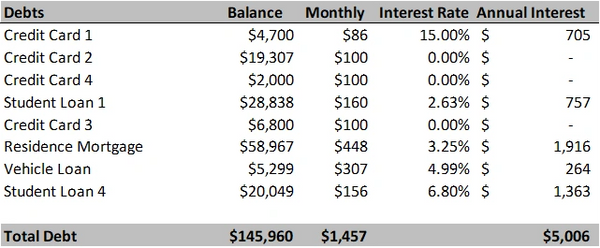

I reduced my expenses and put every extra dollar toward the debt:

- cut down on groceries

- lowered my utilities

- stopped clothes shopping

- reduced eating out

Paid off $30K in one year.

I continued doing what worked:

- Lived lean

- Prioritized expenses

- Took advantage of 0% credit card deals

- Got a raise at work

Paid off $50K in this year.

I was getting so close to paying off my debt at this point.

There was only $10K of regressive debt (bad debt) remaining

and $53K of progressive debt (debt on appreciating assets) remaining.

Finally paid off all debt with the help of selling my fixer upper home!

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.